"DDG Net Worth" refers to the estimated financial value of DuckDuckGo, a popular privacy-focused search engine. The company's net worth is primarily derived from advertising revenue and other business ventures.

DDG's commitment to user privacy has set it apart from other search engines and contributed to its growing popularity. The company's transparent business practices and ethical approach to data handling have resonated with privacy-conscious users, leading to a loyal following and increased brand value.

As the demand for privacy-focused internet services continues to rise, DDG is well-positioned to capitalize on this growing market. The company's innovative search engine, coupled with its strong financial foundation, suggests a promising future for DDG and its net worth.

DDG Net Worth

DDG's net worth is a reflection of its financial strength and stability. Key aspects influencing its net worth include:

- Revenue

- Profitability

- Debt

- Assets

- Investments

- Brand value

- Market share

- User growth

DDG's revenue is primarily generated through advertising, with a focus on privacy-respecting ads. The company's profitability has been increasing in recent years, indicating its financial health. DDG has minimal debt and a strong asset base, providing a solid financial foundation. Its investments in research and development are aimed at enhancing its search engine technology and user experience. DDG's strong brand value, built on trust and privacy, contributes to its overall net worth. The company's growing market share and user base further add to its financial strength.

Revenue

Revenue plays a crucial role in determining DDG's net worth. As a privacy-focused search engine, DDG primarily generates revenue through advertising. Unlike other search engines that collect and sell user data for targeted advertising, DDG prioritizes user privacy and instead focuses on contextual advertising. This approach has allowed DDG to build a loyal user base that values its commitment to privacy. DDG's advertising revenue has been steadily increasing in recent years, reflecting the growing demand for privacy-conscious search services.

The company's commitment to user privacy has not only strengthened its brand value but has also contributed to its financial stability. DDG's revenue is less susceptible to fluctuations in the advertising market compared to search engines that rely heavily on user data collection. This stability is crucial for DDG's long-term financial health and growth.

In conclusion, revenue is a critical component of DDG's net worth. The company's focus on privacy-respecting advertising has allowed it to generate a sustainable revenue stream while maintaining its commitment to user privacy. DDG's strong financial position enables it to invest in research and development, expand its services, and continue to grow its market share.

Profitability

Profitability is a crucial factor influencing DDG's net worth. As a for-profit company, DDG's profitability directly impacts its financial health and overall value. Profitability is determined by the difference between revenue and expenses. By generating revenue through advertising while keeping expenses under control, DDG can increase its profitability and, consequently, its net worth.

DDG's commitment to user privacy plays a significant role in its profitability. By prioritizing privacy, DDG has differentiated itself from competitors and attracted a loyal user base. This strong brand identity and customer loyalty allow DDG to command a premium for its advertising services, contributing to its profitability. Additionally, DDG's lean operating model and focus on efficiency have helped the company maintain healthy profit margins.

In conclusion, profitability is a vital component of DDG's net worth. DDG's unique approach to advertising, combined with its commitment to privacy and operational efficiency, has enabled the company to achieve strong profitability. This profitability has contributed to DDG's financial stability and has allowed the company to invest in growth initiatives, further increasing its net worth.

Debt

Debt is a crucial aspect influencing DDG's net worth. It represents the financial obligations that DDG owes to external entities, such as banks or investors. Managing debt effectively is essential for maintaining financial stability and long-term growth.

- Debt Financing: DDG may utilize debt financing to fund its operations, such as expanding its infrastructure or investing in research and development. Debt financing involves borrowing money from lenders at a specified interest rate, which adds to DDG's expenses but can also provide leverage for growth.

- Debt Management: DDG's debt management strategy is crucial for its financial health. The company must carefully balance its debt levels to maintain a manageable debt-to-equity ratio. Prudent debt management allows DDG to maintain investor confidence and avoid financial distress.

- Debt Repayment: DDG's ability to repay its debts on time demonstrates its financial stability and creditworthiness. Timely debt repayment reduces the risk of default and helps DDG maintain, which can lower its borrowing costs in the future.

- Debt Restructuring: In certain circumstances, DDG may consider debt restructuring to modify the terms of its existing debt obligations. Restructuring can involve extending debt maturities, reducing interest rates, or converting debt into equity. However, it should be carefully evaluated to ensure that it aligns with DDG's long-term financial goals.

Effective debt management is essential for DDG to maintain a strong financial foundation and maximize its net worth. By carefully considering debt financing, managing debt levels, and fulfilling its debt obligations, DDG can position itself for continued growth and success.

Assets

Understanding the relationship between assets and DDG's net worth is crucial for evaluating the company's financial health and overall value. Assets represent the resources owned or controlled by DDG that have economic value and contribute to its net worth.

- Current Assets: These are assets that can be easily converted into cash within one year. They include cash and cash equivalents, accounts receivable, and inventory. Strong current assets indicate DDG's ability to meet its short-term financial obligations and fund its day-to-day operations.

- Non-Current Assets: These are assets that are not easily convertible into cash within one year. They include property, plant, and equipment (PP&E), as well as intangible assets such as patents and trademarks. Non-current assets represent DDG's long-term investments and contribute to its overall value.

- Investments: DDG may hold investments in other companies or financial instruments as part of its investment strategy. These investments can generate additional income and contribute to the company's overall net worth.

- Other Assets: This category may include any other assets that do not fit into the above categories, such as prepaid expenses or deferred charges. These assets can also contribute to DDG's net worth, albeit to a lesser extent.

In conclusion, assets play a vital role in determining DDG's net worth. The company's ability to manage its assets effectively, including acquiring, deploying, and liquidating them strategically, is essential for maintaining a strong financial position and creating long-term value for its stakeholders.

Investments

Investments are a crucial aspect of DDG's financial strategy and contribute significantly to its net worth. The company's investment portfolio diversifies its revenue streams and provides potential for long-term growth.

- Equity Investments: DDG may invest in stocks or bonds of other companies, both within and outside the tech industry. Equity investments offer the potential for capital appreciation and dividend income, enhancing DDG's overall net worth.

- Venture Capital Investments: DDG can invest in early-stage startups and emerging technologies through venture capital funds. These investments carry higher risk but also have the potential for significant returns if the startups succeed.

- Real Estate Investments: DDG may invest in commercial or residential properties to generate rental income and benefit from potential property value appreciation. Real estate investments provide diversification and can contribute to the company's long-term wealth.

- Other Investments: DDG may also explore alternative investments such as hedge funds, private equity funds, or commodities. These investments offer diversification and the potential to enhance returns beyond traditional asset classes.

DDG's investment strategy is driven by a combination of factors, including risk tolerance, return objectives, and the overall financial health of the company. By carefully managing its investment portfolio, DDG aims to maximize its net worth while mitigating potential risks.

Brand value

Brand value is a crucial factor influencing "ddg net worth". It represents the intangible worth of the DDG brand, encompassing customer perception, brand recognition, and loyalty. A strong brand value translates to increased revenue, customer acquisition, and overall financial strength.

- Brand loyalty: Loyal customers are more likely to choose DDG over competitors, contributing to a stable revenue stream and reducing customer acquisition costs.

- Customer trust: DDG's commitment to user privacy and ethical practices has fostered trust among its users, enhancing brand value and customer retention.

- Brand reputation: DDG's positive brand reputation, built on transparency and a customer-centric approach, attracts new users and strengthens existing customer relationships.

- Brand differentiation: DDG's unique focus on privacy and its commitment to providing a user-friendly search experience differentiate it from competitors, creating a strong brand identity.

In conclusion, brand value is a significant driver of "ddg net worth". DDG's strong brand loyalty, customer trust, positive reputation, and differentiation contribute to its financial success and overall value.

Market share

Market share is a crucial factor influencing "ddg net worth". It represents the percentage of total search engine market controlled by DuckDuckGo. A higher market share translates to increased revenue potential and overall financial strength.

- User base: A larger user base indicates a higher market share and a wider reach for DDG's advertising services, leading to increased revenue.

- Search volume: The number of searches conducted on DDG contributes to its market share. A higher search volume indicates greater usage and preference for DDG, strengthening its position in the search engine industry.

- Ad revenue: Market share directly impacts DDG's advertising revenue. A larger market sharemore advertisers choosing DDG's platform, resulting in higher revenue generation.

- Brand recognition: A strong market share helps establish DDG as a recognized and trusted brand in the search engine space, enhancing its overall brand value and reputation.

In conclusion, market share plays a significant role in determining "ddg net worth". By increasing its market share, DDG can expand its user base, attract more advertisers, and enhance its brand reputation, all of which contribute to its financial success and overall value.

User growth

User growth is a critical factor influencing "ddg net worth". As DuckDuckGo attracts more users to its search engine, its overall value and financial strength increase. Several key reasons contribute to this connection:

Firstly, a larger user base leads to increased advertising revenue. DDG primarily generates revenue through advertising, and a higher number of users means a wider reach for its advertising services. This increased reach attracts more advertisers and commands higher advertising rates, directly contributing to DDG's revenue and, consequently, its net worth.

Secondly, user growth strengthens DDG's brand value. A growing user base indicates that DDG is meeting the needs of its users and gaining recognition in the search engine market. This positive brand perception enhances DDG's reputation, making it more attractive to both users and advertisers, further contributing to its overall value.

Thirdly, user growth provides valuable data and insights. By analyzing user behavior and search patterns, DDG can improve its search algorithm, personalize user experiences, and develop new features that meet the evolving needs of its users. This continuous improvement loop helps DDG maintain its competitive edge and further drive user growth, creating a virtuous cycle that benefits both users and the company's net worth.

In conclusion, user growth is a key component of "ddg net worth". By attracting and retaining a growing user base, DDG increases its advertising revenue, strengthens its brand value, and gains valuable insights to improve its services. This virtuous cycle contributes significantly to the company's overall financial success and net worth.

FAQs about DDG Net Worth

This section addresses frequently asked questions surrounding DDG's net worth, providing clear and informative answers to enhance understanding.

Question 1: How is DDG's net worth calculated?

DDG's net worth is estimated using various financial metrics, including revenue, profitability, debt, assets, investments, brand value, market share, and user growth. Analysts consider these factors to determine the company's overall financial health and value.

Question 2: What are the key factors influencing DDG's net worth?

Several key factors influence DDG's net worth, including its user base, advertising revenue, brand reputation, market share, and financial management strategies. The company's ability to execute its business plan and adapt to industry trends also plays a significant role.

Question 3: How does DDG's commitment to privacy impact its net worth?

DDG's commitment to user privacy has both positive and potential negative impacts on its net worth. On the one hand, it differentiates DDG from competitors and attracts privacy-conscious users, leading to increased brand value and customer loyalty. On the other hand, it may limit DDG's advertising revenue compared to search engines that collect and sell user data.

Question 4: What are the potential risks to DDG's net worth?

DDG's net worth is subject to various risks, including competition from larger search engines, changes in user preferences, privacy regulations, and economic downturns. The company's ability to mitigate these risks and capitalize on growth opportunities will be crucial for maintaining and increasing its net worth.

Question 5: How does DDG's financial performance compare to other search engines?

DDG's financial performance is generally smaller in scale compared to dominant search engines, but it has shown consistent growth in recent years. The company's focus on privacy and ethical practices differentiates it from competitors and has resonated with a growing number of users.

Question 6: What is the outlook for DDG's net worth in the future?

DDG's future net worth is influenced by various factors, including its ability to maintain its competitive edge, expand its user base, and adapt to evolving industry trends. The company's commitment to privacy, coupled with its strong financial management, positions it well for continued growth and value creation.

Summary: DDG's net worth is a reflection of its financial health and growth potential. By understanding the key factors influencing its net worth, we gain insights into the company's strengths, weaknesses, and future prospects.

Transition to the next article section: This concludes our exploration of DDG's net worth. In the next section, we will delve into the company's financial strategies and how they contribute to its overall financial performance.

Tips for Understanding DDG Net Worth

Understanding the concept of DDG's net worth requires a comprehensive approach. Here are several tips to enhance your comprehension:

Tip 1: Consider the Company's Financial MetricsAnalyze DDG's revenue, profitability, debt, assets, investments, and other financial indicators to gain a holistic view of its financial health. These metrics provide insights into the company's financial performance and stability.Tip 2: Understand the Impact of User Growth

DDG's user base plays a pivotal role in its net worth. A growing user base indicates increased advertising revenue, enhanced brand value, and valuable data for improving its services.Tip 3: Assess DDG's Market Positioning

DDG's market share and competitive landscape are crucial factors to consider. Determine its position relative to other search engines and understand how it differentiates itself in the market.Tip 4: Evaluate DDG's Privacy Commitment

DDG's commitment to user privacy sets it apart, but it also has financial implications. Analyze how this commitment affects its revenue streams and brand value.Tip 5: Monitor DDG's Financial Performance

Regularly review DDG's financial performance, including revenue growth, profitability, and debt management. This will provide insights into the company's financial health and growth trajectory.

By following these tips, you can gain a deeper understanding of DDG's net worth and its contributing factors. This knowledge enables informed decision-making and a comprehensive evaluation of the company's financial position.

Transition: Understanding DDG's net worth is essential for assessing its financial health and growth potential. By incorporating these tips into your analysis, you can develop a well-rounded perspective on the company's overall value and performance.

DDG Net Worth

In conclusion, DDG's net worth serves as a testament to its commitment to user privacy, financial stability, and long-term growth. The company's unique approach to advertising, combined with its strong brand value and growing market share, has positioned it for continued success.

As the demand for privacy-conscious search services continues to rise, DDG is well-positioned to capitalize on this growing market. The company's innovative search engine, coupled with its strong financial foundation, suggests a promising future for DDG and its net worth. Investors and stakeholders alike should closely monitor DDG's progress as it navigates the evolving search engine landscape and strives to create even greater value for its users.

Unveiling The Secrets: Dev Patel's Weight Loss Journey And Transformation

Unveiling The Wealth Behind Gaming's Creative Genius: Todd Howard's Net Worth

Unveiling The Enigma: Exploring The World Of Daphne Clunes

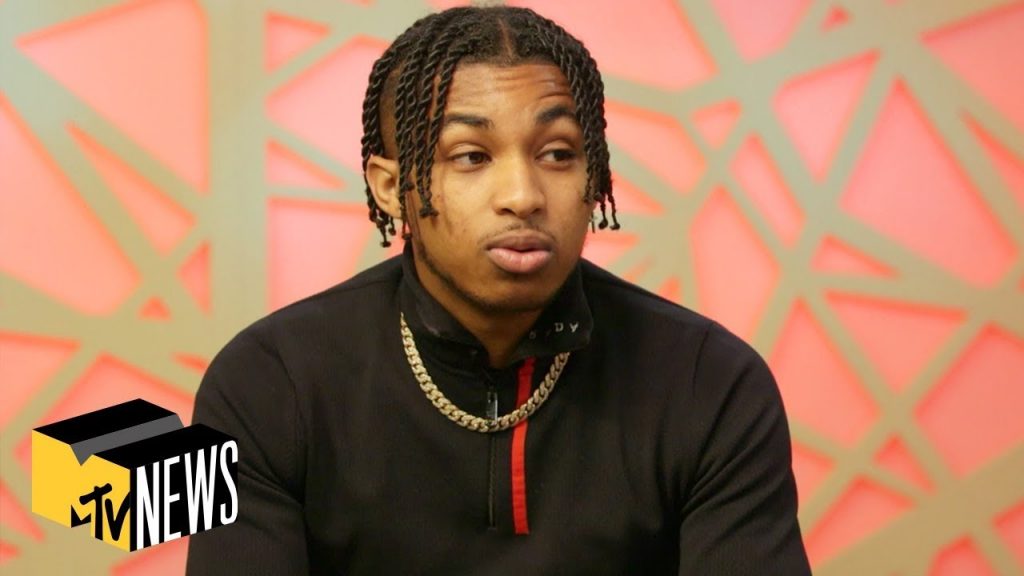

DDG Bio & Wiki Net Worth, Age, Height & Weight

DDG net worth 2021, real name, height, brother, songs, IG Briefly.co.za

DDG Bio & Wiki Net Worth, Age, Height & Weight

ncG1vNJzZmirn6KyorSNrGpnraNixKa%2F02ZpZ5mdlsewusCwqmebn6J8pbDGZqWerF2svLPAx2efraWc