The result of dividing 3 by 150 is 0.02 or 2/100.

This seemingly insignificant fraction has garnered attention in various fields, including finance, investing, and economics. Notably, it represents an interest rate of 2 basis points or 0.02%, a value commonly used as a benchmark or reference point for financial calculations and analysis.

In the realm of investing, a 2 basis point change in interest rates can have a significant impact on bond prices and yields, influencing investment decisions and portfolio strategies. Moreover, central banks often utilize changes in interest rates, even by small increments like 2 basis points, as a monetary policy tool to manage inflation, stimulate economic growth, or curb market volatility.

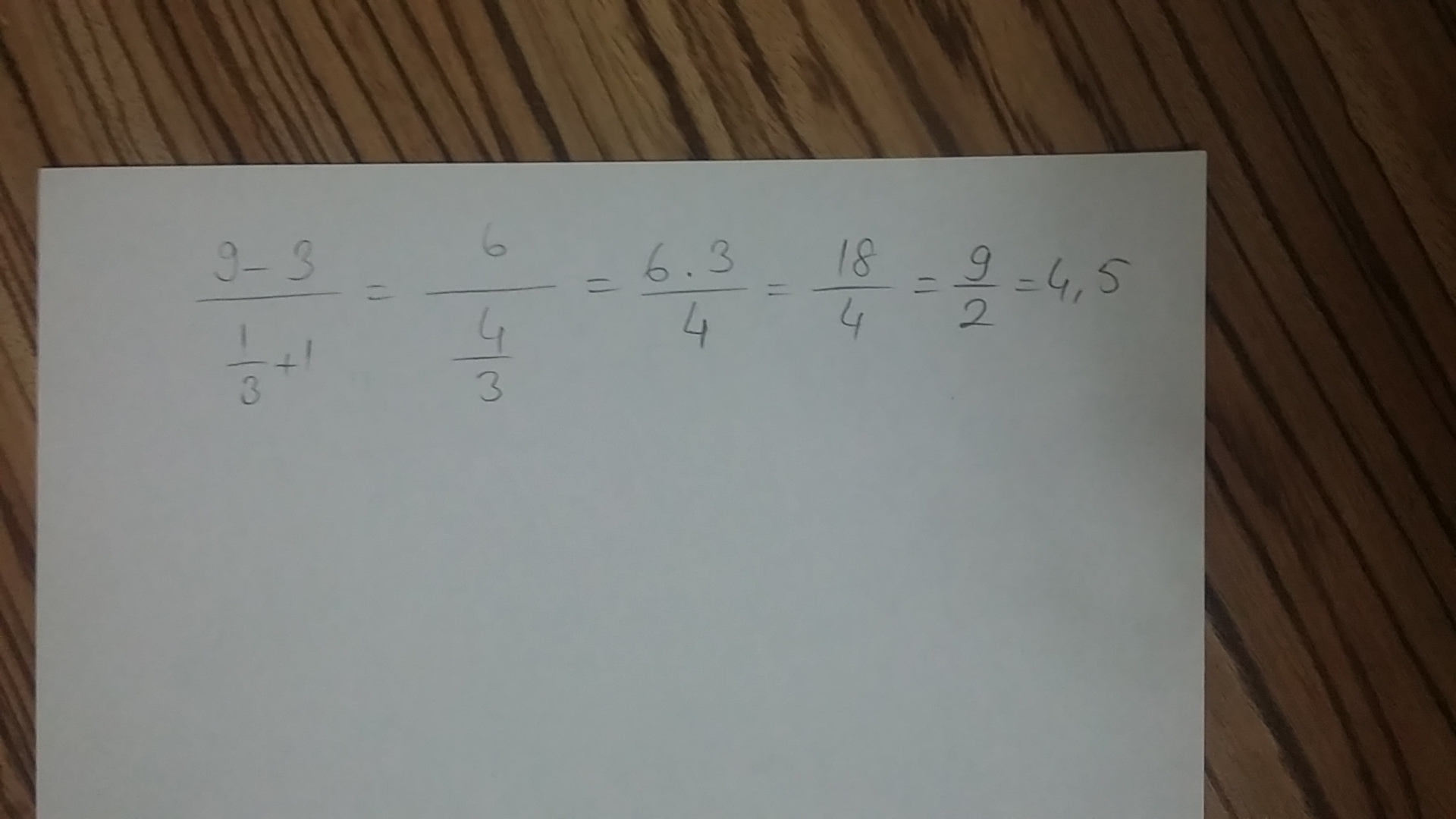

3 Divided by 150

The seemingly simple mathematical expression "3 divided by 150" holds significance in various fields, particularly in finance and economics. Exploring its diverse dimensions, we uncover eight key aspects that shed light on its importance and relevance:

- Mathematical Expression: The result of dividing 3 by 150 is 0.02 or 2/100.

- Financial Benchmark: It represents an interest rate of 2 basis points or 0.02%, commonly used as a reference point for financial calculations.

- Bond Pricing: A 2 basis point change in interest rates can significantly impact bond prices and yields.

- Investment Decisions: Investors consider 2 basis point changes when making investment decisions and adjusting portfolio strategies.

- Central Bank Tool: Central banks use changes in interest rates, including 2 basis point increments, as a monetary policy tool.

- Inflation Management: Adjusting interest rates by 2 basis points can help manage inflation and maintain economic stability.

- Economic Stimulus: Central banks may lower interest rates by 2 basis points to stimulate economic growth during downturns.

- Market Volatility: Changes in interest rates, even by 2 basis points, can influence market volatility and investor sentiment.

These aspects highlight the multifaceted nature of "3 divided by 150," demonstrating its importance in shaping financial markets, influencing investment decisions, and contributing to economic policy. Understanding these dimensions provides a deeper appreciation for the significance of this seemingly simple mathematical expression in the world of finance and economics.

Mathematical Expression

The mathematical expression "3 divided by 150 is 0.02 or 2/100" establishes the numerical value and equivalent fraction of the division operation. This seemingly simple calculation forms the basis for understanding the significance of "3 divided by 150" in various fields, particularly finance and economics.

- Basis Point Representation: 0.02, the result of the division, is equivalent to 2 basis points. This concept is crucial in finance, where interest rates and other financial metrics are often expressed in basis points.

- Percentage Interpretation: 0.02 can also be expressed as 2/100, representing two hundredths or 2 percent. This percentage interpretation is useful for comprehending the magnitude of changes in financial markets.

- Decimal Notation: The decimal notation of 0.02 provides a precise and universally recognized representation of the mathematical expression, facilitating calculations and comparisons across different contexts.

- Fractional Equivalence: The fraction 2/100 offers an alternative representation of the division result, emphasizing the mathematical relationship between the numerator (3) and the denominator (150).

Understanding these facets of the mathematical expression "3 divided by 150 is 0.02 or 2/100" lays the foundation for exploring its broader implications in finance, economics, and other relevant disciplines.

Financial Benchmark

The connection between "3 divided by 150" and its significance as a financial benchmark lies in the mathematical relationship between these elements. The result of dividing 3 by 150 is 0.02 or 2/100, which represents an interest rate of 2 basis points or 0.02%.

- Basis Point Definition: A basis point is a unit of measurement equal to one-hundredth of one percent (0.01%). Therefore, 2 basis points is equivalent to 0.02%.

- Reference Rate: The 2 basis point interest rate derived from "3 divided by 150" serves as a reference point for financial calculations and analysis.

- Bond Pricing and Yields: Changes in interest rates, including 2 basis point increments, can significantly impact bond prices and their corresponding yields.

- Investment Decisions: Investors closely monitor changes in interest rates, including those as small as 2 basis points, when making investment decisions and adjusting portfolio strategies.

In summary, the connection between "3 divided by 150" and its role as a financial benchmark lies in the mathematical relationship that establishes 2 basis points or 0.02% as a reference point for various financial calculations and decision-making processes.

Bond Pricing

The connection between bond pricing and the mathematical expression "3 divided by 150" becomes evident when considering the financial implications of a 2 basis point change in interest rates, which is equivalent to the result of dividing 3 by 150.

- Inverse Relationship of Bond Prices and Interest Rates: Generally, bond prices and interest rates exhibit an inverse relationship. When interest rates rise, bond prices tend to fall, and vice versa.

- Impact on Bond Yields: A 2 basis point increase in interest rates can lead to a decrease in bond yields, making existing bonds less attractive to investors and potentially causing their prices to drop.

- Duration and Sensitivity: The impact of interest rate changes on bond prices is influenced by the duration of the bond, which measures its sensitivity to interest rate fluctuations.

In summary, the connection between bond pricing and "3 divided by 150" lies in the mathematical representation of a 2 basis point change in interest rates, which can significantly affect the prices and yields of bonds, particularly those with longer durations.

Investment Decisions

The connection between "Investment Decisions: Investors consider 2 basis point changes when making investment decisions and adjusting portfolio strategies" and "3 divided by 150" lies in the financial significance of a 2 basis point change in interest rates, which is the mathematical equivalent of dividing 3 by 150. Investors closely monitor interest rate movements, including those as small as 2 basis points, as they can have a noticeable impact on investment returns and portfolio performance.

When interest rates rise by 2 basis points, it can lead to a decrease in bond prices, making stocks and other riskier assets relatively more attractive. This can prompt investors to adjust their portfolios by reducing their bond holdings and increasing their exposure to stocks or other growth-oriented investments. Conversely, a 2 basis point decrease in interest rates can make bonds more appealing, potentially leading investors to shift their portfolios towards fixed income securities.

Understanding the connection between "3 divided by 150" and investment decisions is crucial for investors seeking to make informed choices and adapt their portfolios to changing market conditions. By considering the impact of even small changes in interest rates, investors can make strategic decisions that align with their risk tolerance and financial goals.

Central Bank Tool

The connection between "3 divided by 150" and "Central Bank Tool: Central banks use changes in interest rates, including 2 basis point increments, as a monetary policy tool" lies in the mathematical representation of a 2 basis point change in interest rates. Central banks often utilize changes in interest rates as a tool to influence economic activity and achieve specific policy objectives.

When a central bank decides to adjust interest rates, it can do so in increments as small as 2 basis points, which is equivalent to the result of dividing 3 by 150. By making small, gradual changes, central banks can fine-tune monetary policy and respond to economic conditions without causing significant market disruptions.

For example, if an economy is experiencing high inflation, the central bank may raise interest rates by 2 basis points to curb inflation and stabilize prices. Conversely, if the economy is facing a recession, the central bank may lower interest rates by 2 basis points to stimulate economic activity and encourage borrowing and spending.

Understanding the connection between "3 divided by 150" and central bank policy is crucial for financial professionals, investors, and policymakers. By recognizing the significance of even small changes in interest rates, individuals can make informed decisions and adjust their strategies accordingly.

Inflation Management

The connection between "Inflation Management: Adjusting interest rates by 2 basis points can help manage inflation and maintain economic stability" and "3 divided by 150" lies in the mathematical representation of a 2 basis point change in interest rates, which is equivalent to the result of dividing 3 by 150. Central banks often utilize changes in interest rates as a tool to control inflation and ensure economic stability.

When inflation, or the general increase in prices of goods and services, becomes a concern, central banks may raise interest rates by 2 basis points. This increase in interest rates makes borrowing more expensive for businesses and consumers, reducing the amount of money in circulation. As a result, demand for goods and services decreases, which helps to curb inflation and stabilize prices.

For example, in 2022, the Federal Reserve raised interest rates by 2 basis points in an effort to combat rising inflation. This move was successful in slowing down the rate of inflation and maintaining economic stability.

Understanding the connection between "3 divided by 150" and inflation management is crucial for policymakers and economists. By recognizing the significance of even small changes in interest rates, they can make informed decisions to manage inflation and ensure the overall health of the economy.

Economic Stimulus

The connection between "Economic Stimulus: Central banks may lower interest rates by 2 basis points to stimulate economic growth during downturns." and "3 divided by 150" lies in the mathematical representation of a 2 basis point change in interest rates, which is equivalent to the result of dividing 3 by 150. Central banks often utilize changes in interest rates as a tool to influence economic activity and achieve specific policy objectives.

- Role of Interest Rates in Economic Stimulus: Interest rates play a crucial role in stimulating economic growth during downturns. By lowering interest rates by 2 basis points, central banks make borrowing more affordable for businesses and consumers, thereby encouraging spending and investment.

- Impact on Business Investment: Lower interest rates can incentivize businesses to invest in new projects and expand their operations. This increased investment leads to job creation and economic growth.

- Consumer Spending and Confidence: Lower interest rates can boost consumer spending by making it more affordable for individuals to purchase goods and services. This increased spending can help stimulate economic activity and create a positive feedback loop.

- Monetary Policy Signaling: Central banks' decision to lower interest rates by 2 basis points can signal to businesses and investors that the economy is in need of support and that the central bank is committed to fostering economic growth.

In conclusion, the connection between "3 divided by 150" and economic stimulus lies in the mathematical representation of a 2 basis point change in interest rates. By lowering interest rates by this amount, central banks can help stimulate economic growth, encourage investment, boost consumer spending, and signal their commitment to supporting the economy during downturns.

Market Volatility

The connection between "Market Volatility: Changes in interest rates, even by 2 basis points, can influence market volatility and investor sentiment." and "3 divided by 150" lies in the mathematical representation of a 2 basis point change in interest rates, which is equivalent to the result of dividing 3 by 150. Changes in interest rates, regardless of their magnitude, can have a significant impact on financial markets and investor behavior.

Interest rate changes can affect market volatility by altering the expectations and risk appetite of investors. When interest rates rise, investors may become more risk-averse and withdraw their funds from risky assets, such as stocks, leading to increased volatility in the stock market. Conversely, when interest rates fall, investors may become more risk-tolerant and allocate more funds to stocks, resulting in decreased volatility.

Investor sentiment is also influenced by changes in interest rates. Rising interest rates can dampen investor sentiment, leading to a pessimistic outlook on the economy and future investment returns. Conversely, falling interest rates can boost investor sentiment, creating a more optimistic outlook and encouraging investment.

Understanding the connection between "3 divided by 150" and market volatility is crucial for investors and market participants. By recognizing that even small changes in interest rates can impact market behavior, investors can make informed decisions about their investment strategies and risk management.

Frequently Asked Questions About "3 Divided by 150"

This section addresses common questions and misconceptions surrounding the concept of "3 divided by 150." Each question is answered concisely, providing clear and informative explanations.

Question 1: What is the significance of "3 divided by 150"?

Answer: "3 divided by 150" represents a mathematical expression that equates to 0.02 or 2 basis points. It holds importance in finance and economics, serving as a benchmark for interest rates and a reference point for various financial calculations.

Question 2: How does "3 divided by 150" relate to interest rates?

Answer: The result of "3 divided by 150," which is 2 basis points, represents a small change in interest rates. Central banks and financial institutions often use basis points to adjust interest rates, influencing economic activity and managing inflation.

Question 3: What impact can a 2 basis point change in interest rates have?

Answer: Even a seemingly small change of 2 basis points in interest rates can significantly affect bond prices, yields, and investment decisions. It can also influence consumer spending, business investment, and overall economic growth.

Question 4: How is "3 divided by 150" used in financial analysis?

Answer: The concept of "3 divided by 150" provides a basis for calculating and comparing interest rates, bond yields, and other financial metrics. It allows analysts to assess the potential impact of interest rate changes on various financial instruments and markets.

Question 5: What is the connection between "3 divided by 150" and market volatility?

Answer: Changes in interest rates, including those as small as 2 basis points, can influence market volatility. Shifts in interest rates can affect investor sentiment, risk appetite, and the overall stability of financial markets.

Question 6: Why is it important to understand the concept of "3 divided by 150"?

Answer: Grasping the significance of "3 divided by 150" is crucial for professionals in finance, economics, and investing. It provides a foundational understanding of how interest rates are measured, analyzed, and used to shape economic policies and investment strategies.

Summary: The concept of "3 divided by 150" holds relevance in finance and economics, representing a 2 basis point change in interest rates. Understanding its implications is essential for comprehending financial markets, analyzing investment opportunities, and staying informed about economic policies.

Transition to the Next Article Section: This section has explored the concept of "3 divided by 150" and its significance in various financial contexts. In the next section, we will delve deeper into the practical applications of this concept and its impact on real-world financial decisions.

3 Divided by 150

The concept of "3 divided by 150" holds significant implications in the financial world, particularly in relation to interest rates and their impact on markets and economies. To fully grasp its importance, it is essential to consider the following tips:

Tip 1: Recognize the Basis Point Representation

The result of dividing 3 by 150, which is 0.02, represents a change of 2 basis points in interest rates. Basis points are a convenient unit for measuring small variations in interest rates, commonly used by central banks and financial institutions.

Tip 2: Understand the Impact on Bond Prices

Changes in interest rates, even by 2 basis points, can have a noticeable effect on bond prices. Typically, an increase in interest rates leads to a decrease in bond prices, and vice versa. This relationship is crucial for investors who trade in fixed-income securities.

Tip 3: Consider the Influence on Investment Decisions

Fluctuations in interest rates, including those as small as 2 basis points, can influence investment decisions. Investors monitor interest rate changes to assess their potential impact on various asset classes, such as stocks and bonds, and adjust their portfolios accordingly.

Tip 4: Analyze the Role in Central Bank Policy

Central banks utilize changes in interest rates, including 2 basis point increments, as a monetary policy tool. By adjusting interest rates, central banks aim to manage inflation, influence economic growth, and maintain financial stability.

Tip 5: Monitor the Effect on Market Volatility

Changes in interest rates, regardless of their magnitude, can affect market volatility. Shifts in interest rates can influence investor sentiment and risk appetite, leading to fluctuations in asset prices and overall market stability.

Summary: Understanding the concept of "3 divided by 150" and its implications is crucial for professionals in finance and economics. By considering these tips, individuals can develop a deeper comprehension of how interest rates are measured, analyzed, and used to shape economic policies and investment strategies.

3 Divided by 150

In conclusion, the concept of "3 divided by 150" holds significant importance in finance and economics, representing a 2 basis point change in interest rates. Understanding its implications is essential for professionals and investors seeking to make informed decisions and navigate the complexities of financial markets.

Throughout this article, we have explored the diverse dimensions of "3 divided by 150," examining its role as a financial benchmark, its impact on bond prices and investment decisions, and its significance in central bank policy and market volatility. Recognizing the importance of even seemingly small changes in interest rates, individuals can better grasp the dynamics of financial markets and make informed choices about their investments and economic strategies.

Unveiling The "Kevin Hart Laughing Meme": Insights And Discoveries

Uncover The Secrets To Field Hockey Success With RWU

Unlock The Secrets: How To Cancel Your Groomie Subscription Effortlessly

Articles 3 Divided By 1 9 More Educational Events

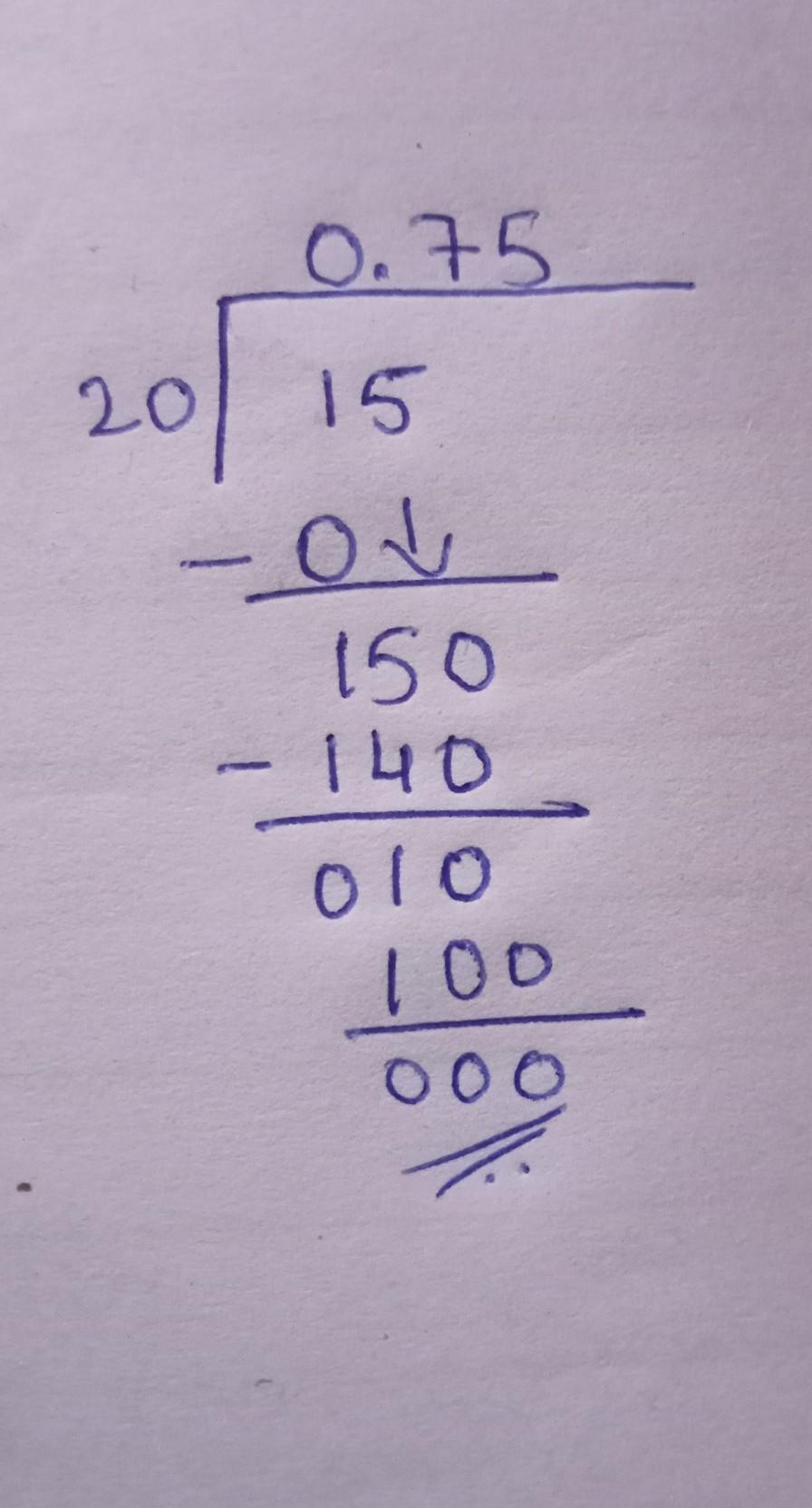

15 divided by 20 how to calculate by using long division method

ncG1vNJzZmirn6i8ra3Lmmlnq2NjwrR51p6qrWViY66urdmopZqvo2OwsLmObGSdoaaesaawjJuwZmllZXupwMyl