Dave Abrams Net Worth refers to the total value of the assets and income of an individual named Dave Abrams. It is often used to measure an individual's financial success and is calculated by subtracting liabilities from assets.

Determining an individual's net worth can provide insights into their financial well-being and stability. It can also impact financial decisions such as loan applications, investments, and retirement planning. Understanding net worth is crucial for individuals to manage their finances effectively and make informed financial choices.

To calculate net worth, one needs to consider all assets, including cash, investments, real estate, and personal belongings. Liabilities, such as mortgages, loans, and outstanding bills, are then subtracted from the total assets to arrive at the net worth figure.

Dave Abrams Net Worth

Understanding Dave Abrams' net worth involves examining key aspects that contribute to his overall financial standing. Here are nine essential aspects to consider:

- Assets: Cash, investments, real estate, personal belongings

- Liabilities: Mortgages, loans, outstanding bills

- Income: Earnings from employment, investments, or other sources

- Investments: Stocks, bonds, mutual funds, real estate

- Debt: Amount owed on loans or credit cards

- Net worth: Total assets minus total liabilities

- Financial stability: A measure of an individual's ability to meet financial obligations

- Investment strategy: Plan for managing and growing investments

- Financial goals: Specific financial objectives an individual aims to achieve

These aspects are interconnected and influence Dave Abrams' net worth. For instance, a high net worth may indicate financial stability and a strong investment strategy. Understanding these aspects can provide insights into an individual's financial well-being and decision-making.

Assets

The connection between assets and Dave Abrams' net worth is significant. Assets represent anything of value that Dave Abrams owns, and they contribute directly to his overall financial picture.

- Cash: Dave Abrams' cash on hand, in checking and savings accounts, is a liquid asset that can be easily accessed and used to cover expenses or make investments.

- Investments: Dave Abrams' investments in stocks, bonds, and mutual funds represent a portion of his net worth that has the potential to grow over time. However, investments also carry some level of risk, and their value can fluctuate.

- Real estate: If Dave Abrams owns a home or other real estate properties, these assets contribute to his net worth. Real estate can be a valuable asset, but it also involves ongoing expenses such as property taxes and maintenance costs.

- Personal belongings: Dave Abrams' personal belongings, such as jewelry, art, and collectibles, may also have value and contribute to his net worth. However, the value of personal belongings can be subjective and may not be easily realized in the event of a financial need.

In conclusion, Dave Abrams' net worth is directly influenced by the value of his assets. A diverse portfolio of assets can contribute to financial stability and growth, while a high concentration in any one asset class may increase risk.

Liabilities

Liabilities represent Dave Abrams' financial obligations, such as mortgages, loans, and outstanding bills. Understanding the connection between Dave Abrams' liabilities and his net worth is crucial for assessing his overall financial health.

Liabilities directly impact Dave Abrams' net worth by reducing its value. When Dave Abrams takes on a mortgage or a loan, the amount owed becomes a liability that is subtracted from his total assets. This means that a higher level of liabilities can result in a lower net worth.

For example, if Dave Abrams has $500,000 in assets and $200,000 in liabilities, his net worth would be $300,000. If he takes on an additional $100,000 loan, his net worth would decrease to $200,000. This demonstrates how an increase in liabilities can negatively impact Dave Abrams' net worth.

Managing liabilities effectively is essential for maintaining a healthy net worth. Dave Abrams can achieve this by:

- Prioritizing high-interest debts and paying them off as soon as possible.

- Consolidating debts to secure a lower interest rate and simplify repayment.

- Negotiating with creditors to reduce interest rates or monthly payments.

- Increasing income to cover debt payments more comfortably.

By effectively managing liabilities, Dave Abrams can improve his net worth and secure a stronger financial position.

Income

Income plays a vital role in determining Dave Abrams' net worth. It represents the inflow of funds that can be used to acquire assets, reduce liabilities, and ultimately increase his overall financial standing.

- Employment Income: Dave Abrams' earnings from his job or business contribute directly to his net worth. A stable and high-paying job can provide a steady stream of income that can be used to cover expenses, save for the future, and invest in assets.

- Investment Income: If Dave Abrams has invested in stocks, bonds, or other financial instruments, the income generated from these investments can also contribute to his net worth. Investment income can take the form of dividends, interest payments, or capital gains.

- Other Sources of Income: Dave Abrams may also have income from other sources, such as rental properties, royalties, or passive income streams. These additional sources of income can further enhance his net worth and provide financial flexibility.

The connection between income and Dave Abrams' net worth is clear. By increasing his income through various sources, he can accumulate more assets, reduce liabilities, and ultimately grow his net worth over time. A strong and diverse income stream is crucial for financial stability and long-term wealth creation.

Investments

Investments play a critical role in shaping Dave Abrams' net worth. By allocating a portion of his assets to stocks, bonds, mutual funds, and real estate, Dave Abrams can potentially increase his wealth over time through capital appreciation and income generation.

Investing in stocks involves purchasing shares of ownership in publicly traded companies. When the value of these companies increases, so does the value of Dave Abrams' investments. Similarly, investing in bonds involves lending money to governments or corporations for a fixed period, earning interest payments in return. Mutual funds provide diversification by investing in a basket of stocks or bonds, reducing risk compared to investing in individual securities.

Real estate can also be a valuable investment for Dave Abrams. Rental properties can generate passive income, while the value of the property itself may appreciate over time. However, real estate investments require careful consideration of factors such as location, property condition, and market trends.

The connection between investments and Dave Abrams' net worth is evident. By making wise investment decisions, Dave Abrams can potentially grow his wealth and secure his financial future. However, it's important to note that investments carry inherent risks, and the value of investments can fluctuate.

Debt

Understanding the connection between "Debt: Amount owed on loans or credit cards" and "dave abrams net worth" is crucial for assessing Dave Abrams' overall financial health and stability. Debt represents Dave Abrams' financial obligations, primarily consisting of money owed on loans or credit cards.

- Impact on Net Worth: Debt directly reduces Dave Abrams' net worth by decreasing the value of his assets. When Dave Abrams takes on debt, the amount owed becomes a liability that is subtracted from his total assets. A higher level of debt can result in a lower net worth.

- Interest Payments: Debt often incurs interest charges, which Dave Abrams must pay regularly. These interest payments represent an additional expense that reduces his disposable income and limits his ability to save and invest.

- Credit Utilization: High levels of debt can negatively impact Dave Abrams' credit utilization ratio, which measures the amount of credit he is using compared to his total available credit. A high credit utilization ratio can lower his credit score, making it more difficult and expensive to obtain future loans.

- Debt-to-Income Ratio: Lenders and creditors also consider Dave Abrams' debt-to-income ratio when evaluating his creditworthiness. A high debt-to-income ratio, where his debt payments consume a large portion of his income, can make it more challenging to qualify for loans or secure favorable interest rates.

Effectively managing debt is essential for Dave Abrams to maintain a healthy net worth. By reducing debt, he can increase his net worth, improve his cash flow, and enhance his overall financial well-being.

Net worth

Net worth, calculated as total assets minus total liabilities, plays a pivotal role in understanding Dave Abrams' financial health and overall well-being. It represents the value of his assets, such as cash, investments, and property, after subtracting his liabilities, such as loans and outstanding bills. Understanding the connection between net worth and Dave Abrams' net worth is crucial for several reasons:

Firstly, net worth is a comprehensive measure of financial standing. It provides a snapshot of Dave Abrams' financial position at a specific point in time, indicating his ability to meet financial obligations and pursue financial goals. A higher net worth generally indicates a stronger financial foundation and greater capacity to withstand financial setbacks.

Secondly, net worth serves as a benchmark for financial progress. By tracking changes in his net worth over time, Dave Abrams can assess the effectiveness of his financial strategies and make adjustments as needed. A growing net worth indicates that his assets are appreciating or his liabilities are decreasing, contributing to his overall financial growth.

Thirdly, net worth is a key factor in loan applications and creditworthiness assessments. Lenders and creditors evaluate Dave Abrams' net worth to determine his ability to repay debts and manage financial risks. A higher net worth can increase his chances of loan approval, secure favorable interest rates, and enhance his overall credit profile.

In summary, understanding the connection between net worth and Dave Abrams' net worth is essential for evaluating his financial health, tracking his financial progress, and making informed financial decisions. It provides a comprehensive view of his financial situation, allowing him to make strategic choices that contribute to his long-term financial well-being.

Financial stability

Financial stability is a crucial aspect that directly connects to "dave abrams net worth." It refers to an individual's ability to manage their financial resources effectively, meet financial obligations, and withstand unexpected financial challenges. Understanding the connection between financial stability and dave abrams net worth is essential for evaluating his overall financial health and well-being.

- Income Stability: Income stability refers to the consistency and reliability of an individual's income sources. A stable income provides a solid foundation for meeting financial obligations and building net worth. For Dave Abrams, a consistent income flow from a secure job or diversified investment portfolio contributes to his financial stability.

- Emergency Fund: An emergency fund is a crucial component of financial stability. It serves as a buffer against unexpected expenses or financial emergencies. Dave Abrams, by maintaining an adequate emergency fund, can minimize the impact of unforeseen events on his net worth and overall financial well-being.

- Debt Management: Effective debt management is essential for financial stability. Dave Abrams' ability to manage debt responsibly, including low debt-to-income ratio and timely debt repayments, contributes to his financial stability and net worth growth.

- Investment Strategy: A well-defined investment strategy can enhance financial stability and contribute to net worth growth. Dave Abrams, by diversifying his investments and adopting a long-term investment horizon, can mitigate risks and potentially increase his overall net worth.

In conclusion, financial stability is a cornerstone of Dave Abrams' net worth. By maintaining a stable income, building an emergency fund, managing debt responsibly, and implementing a sound investment strategy, Dave Abrams can strengthen his financial stability and work towards increasing his net worth over time.

Investment strategy

An investment strategy is a crucial aspect of Dave Abrams' net worth. It outlines a plan for managing and growing his investments, aiming to maximize returns while managing risks. Understanding the connection between investment strategy and Dave Abrams' net worth is essential for evaluating his financial health and long-term wealth creation potential.

- Diversification: Diversification involves spreading investments across different asset classes, such as stocks, bonds, and real estate. By diversifying his portfolio, Dave Abrams can reduce risk and enhance the stability of his net worth. For example, during market downturns that affect specific sectors or asset classes, a diversified portfolio can help mitigate losses and preserve capital.

- Asset Allocation: Asset allocation refers to the distribution of investments among different asset classes based on Dave Abrams' risk tolerance and financial goals. A well-defined asset allocation strategy ensures that his investments align with his risk appetite and long-term objectives. By adjusting asset allocation over time, he can rebalance his portfolio and maintain an appropriate level of risk.

- Rebalancing: Rebalancing involves periodically adjusting the asset allocation strategy to maintain the desired risk-return profile. As market conditions change and Dave Abrams' financial goals evolve, rebalancing helps ensure that his portfolio remains aligned with his investment objectives. Regular rebalancing can help him capture growth opportunities, manage risk, and optimize his net worth.

- Investment Horizon: The investment horizon refers to the time frame over which Dave Abrams plans to hold his investments. A long-term investment horizon generally involves a higher allocation to growth-oriented assets, such as stocks, while a shorter horizon may favor more conservative investments, such as bonds. By considering his investment horizon, he can tailor his strategy to align with his financial goals and risk tolerance.

In conclusion, an effective investment strategy is a cornerstone of Dave Abrams' net worth growth and financial well-being. By implementing a well-defined plan that incorporates diversification, asset allocation, rebalancing, and a suitable investment horizon, Dave Abrams can maximize returns, manage risks, and work towards achieving his long-term financial objectives.

Financial goals

Financial goals are specific financial objectives an individual aims to achieve. They serve as targets that guide financial decision-making and provide motivation for building and managing wealth. Understanding the connection between financial goals and Dave Abrams' net worth is crucial for several reasons.

Firstly, financial goals provide a roadmap for Dave Abrams' financial journey. By setting clear and achievable financial goals, he can prioritize his financial actions and allocate resources effectively. Well-defined financial goals help him stay focused on his financial objectives and make informed decisions that contribute to his net worth growth.

Secondly, financial goals help Dave Abrams measure his financial progress. By tracking his progress towards his goals, he can assess the effectiveness of his financial strategies and make necessary adjustments. Regular monitoring of financial goals allows him to stay on track and make timely course corrections, ensuring that his net worth is growing in line with his expectations.

Thirdly, financial goals provide motivation and a sense of purpose. Having specific financial goals gives Dave Abrams a compelling reason to manage his finances prudently and make informed investment decisions. The desire to achieve his financial goals can drive him to explore new opportunities, take calculated risks, and stay disciplined in his financial habits.

In conclusion, the connection between financial goals and Dave Abrams' net worth is undeniable. Financial goals serve as a guide, a measuring stick, and a source of motivation for his financial journey. By setting clear financial goals, tracking progress, and staying committed to his objectives, Dave Abrams can make informed financial decisions that contribute to the growth of his net worth and overall financial well-being.

FAQs about Dave Abrams Net Worth

This section provides answers to frequently asked questions about Dave Abrams' net worth, offering insights and clarifying common misconceptions.

Question 1: How is Dave Abrams' net worth calculated?

Dave Abrams' net worth is calculated by subtracting his total liabilities, such as debts and outstanding bills, from his total assets, which include cash, investments, and real estate. By understanding this calculation, individuals can gain a clear understanding of his financial standing.

Question 2: What factors contribute to Dave Abrams' net worth?

Dave Abrams' net worth is influenced by various factors, including his income, investments, assets, and liabilities. His income streams, investment strategies, and management of assets and debts all play a significant role in determining the overall value of his net worth.

Question 3: How can Dave Abrams increase his net worth?

Dave Abrams can increase his net worth by focusing on strategies such as increasing his income, making wise investment decisions, managing debt effectively, and optimizing his asset allocation. By implementing these strategies, he can enhance his financial position and work towards growing his net worth.

Question 4: What is the importance of understanding Dave Abrams' net worth?

Understanding Dave Abrams' net worth provides valuable insights into his financial health, stability, and overall well-being. It serves as a benchmark for his financial progress and helps individuals assess his ability to meet financial obligations and pursue financial goals.

Question 5: How does Dave Abrams' net worth impact his financial decisions?

Dave Abrams' net worth plays a crucial role in his financial decision-making. It influences his investment strategies, debt management, and overall financial planning. By considering his net worth, he can make informed choices that align with his financial objectives and long-term goals.

Question 6: What are some common misconceptions about Dave Abrams' net worth?

A common misconception is that Dave Abrams' net worth is solely determined by his income. However, various factors, including his assets, liabilities, and investment strategies, contribute to his overall net worth. It is important to consider the broader picture when evaluating his financial standing.

These FAQs provide a comprehensive overview of Dave Abrams' net worth, its calculation, contributing factors, and its significance. By addressing common questions and misconceptions, this section offers a clear understanding of his financial status and empowers individuals to make informed assessments.

To learn more about Dave Abrams' net worth and its implications, you can explore additional resources or consult with financial professionals for personalized guidance.

Tips on Understanding Dave Abrams Net Worth

Understanding Dave Abrams' net worth requires a comprehensive approach that considers various factors and strategies. Here are several tips to help you gain a deeper insight into his financial standing:

Tip 1: Examine His Assets and Liabilities

Dave Abrams' net worth is calculated by subtracting his liabilities from his assets. To assess his financial health, it is crucial to understand the composition of both his assets and liabilities. Assets may include cash, investments, and real estate, while liabilities encompass debts and outstanding bills.

Tip 2: Consider His Income Sources

Dave Abrams' income plays a significant role in determining his net worth. Analyze his income streams, including employment income, investment income, and any other sources of revenue. A stable and diverse income base can contribute to a higher net worth.

Tip 3: Analyze His Investment Strategies

Dave Abrams' investment strategy is a key factor influencing his net worth. Examine his investment portfolio, including stocks, bonds, and real estate. Evaluate his risk tolerance and investment horizon to understand how these factors shape his investment decisions.

Tip 4: Assess His Debt Management

Effective debt management is crucial for maintaining a healthy net worth. Analyze Dave Abrams' debt-to-income ratio and credit utilization. A high debt burden can negatively impact his net worth and overall financial stability.

Tip 5: Consider His Financial Goals

Dave Abrams' financial goals provide insights into his financial aspirations. Understand his short-term and long-term financial objectives, such as saving for retirement or investing in a business. His goals will influence his financial decisions and contribute to his overall net worth.

Summary: By implementing these tips, you can gain a comprehensive understanding of Dave Abrams' net worth. Remember to consider the interconnectedness of these factors and their impact on his financial well-being.

To further enhance your knowledge, explore additional resources and consult with financial professionals for personalized guidance on evaluating Dave Abrams' net worth and its implications.

Conclusion

In conclusion, Dave Abrams' net worth serves as a comprehensive indicator of his financial well-being. By understanding the various factors that contribute to his net worth, including assets, liabilities, income, investments, and financial goals, we gain valuable insights into his financial standing and ability to meet financial obligations.

Dave Abrams' net worth is not merely a static figure but rather a dynamic measure that can fluctuate over time. As his financial situation evolves, so too will his net worth. By regularly monitoring and evaluating his net worth, he can make informed financial decisions that support his long-term financial objectives and overall well-being.

Unveiling The Enduring Bond: Discoveries In Chevy Chase's Marital Journey

Unveiling Alana Lliteras: A Journey Of Authenticity And Transformation

Uncover The Remarkable Journey Of Israel Adesanya's Brother In Boxing

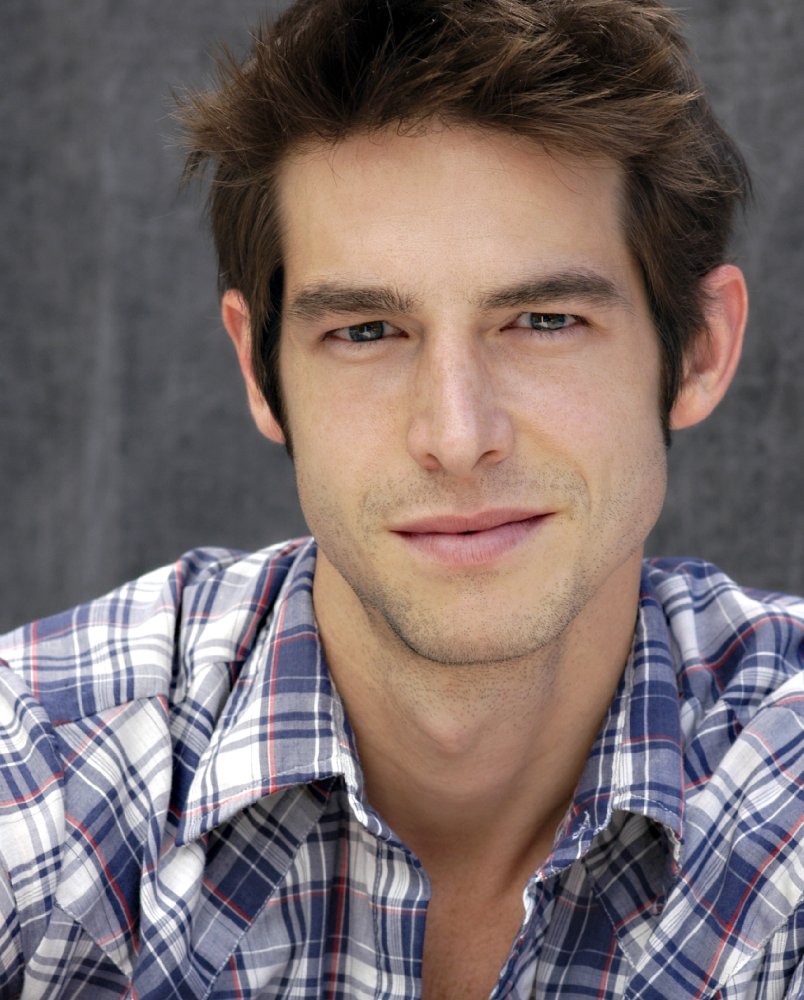

Who is Dave Abrams? Bio Net Worth,Married,Son,Wedding,Dating,Wife

All about celebrity Dave Abrams! Watch list of Movies online 2 Broke

ncG1vNJzZmickaB%2Fb63MrGpnnJmctrWty6ianpmeqL2ir8SsZZynnWSxosLEZpibqpGiwG66xK1ksKeiqbVvtNOmow%3D%3D